Acorns Investment Account

Join more than 9 million people who have saved and invested in the background of life.

30 days bill-FREE. Cancel anytime.

30 days bill-FREE. Cancel anytime. Invest your spare change

Invest your spare change See your performance

See your performanceWhat you get with Acorns Investing

*Round-Up® spare change

*Diversified portfolios built by experts

*Portfolio rebalancing

*Recurring investments

*Education

*Earn Rewards

What is a Portfolio?

*Define “portfolio”

A portfolio is a select combination of investments, often stocks or bonds that you own.

*Stocks & Bonds

Stocks are shares of ownership in a business. Bonds are a debt investment where an investor loans money to a business or government for a defined period of time and interest rate.

*Creating a Portfolio

To create a portfolio, tell us your financial situation and goals. With those answers, Acorns will recommend you a mix of ETFs that will become your portfolio.

What am I investing in?

*Exchange Traded Funds

*Asset classes

Asset classes represent certain categories or classes of stocks or bonds. Each ETF represents an asset class in your portfolio ranging from Large Companies to Real Estate.

*Today’s top companies

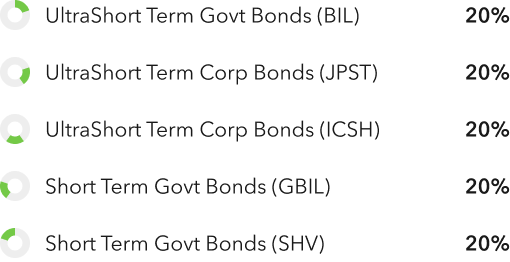

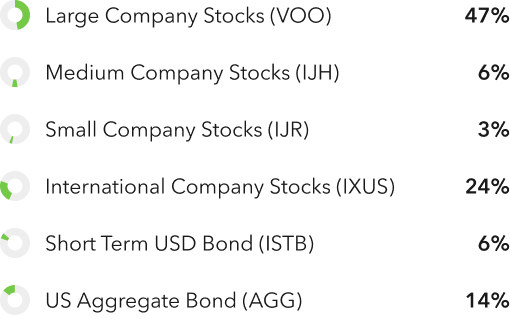

Conservative

Moderately Conservative

Moderately Aggressive

Aggressive

*Invest in yourself & the planet

The Acorns Sustainable Portfolios are made of funds that have been selected based on their environmental, social, and governance business practices, or their ESG rating.

*Link all of your cards

- Link all of your credit or debit cards, so you can start automatically rounding up spare change from every swipe.

*Automatically round-up your spare change

2. We’ll automatically round up your purchases to the next dollar, and invest the change once it adds up to $5.

*Reach your goals

3. Round-Ups® tap into the power of compounding so you can benefit from investing early and often to help reach your long term money goals.

*Retirement

Traditional IRA, Roth IRA, SEP IRA, 401(k) Rollover

*Acorns Later

An easy, automated way to save for retirement.

The way we live and work has changed.

So should the way we invest for retirement.

*Investing for kids

Investment accounts for all of your kids

*Acorns Early

In under 3 minutes, open the easiest investment account for kids, and unlock our full financial wellness system.

We believe your money should work for you. That’s why we’re committed to providing everyday Americans with easy access to some of the best investing and money tools around.

*Simple, transparent plans

Rather than surprise fees, we bundle our products into subscription tiers that support your financial wellness.

*Lite

$1 per month

Getting started? Invest spare change, set Recurring Investments, and more with an easy, automated investment account.

*Personal

$3 per month

All-in-one investment, retirement, and checking, plus a metal debit card, bonus investments, money advice, and more.

Investment accounts for kids, plus personal investment, retirement, and checking accounts, and exclusive offers and content.

Article from acorns.com/early

For more info go to http://www.anitanewbeginnings.com click on Acorn to sign up.

Thank you

October 21st, 2021

October 21st, 2021  AWhite

AWhite  Posted in

Posted in  Tags:

Tags: